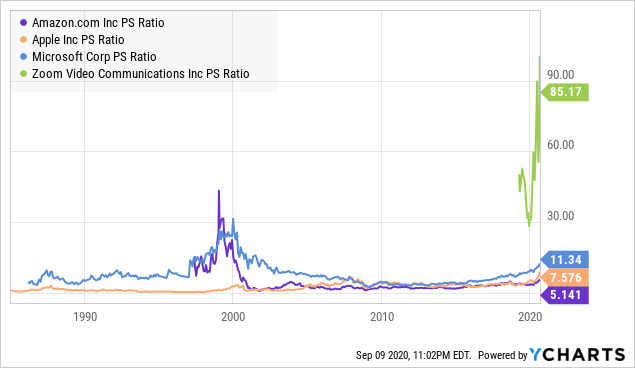

They inflated the value of Zoom stock to an almost absurd level. When Zoom was flying high during the pandemic because everyone from students and churches to your family and your job moved online, investors took notice in a big way.

WHY IS ZOOM STOCK DOWN SOFTWARE

That leaves years of growth for an industry that was on a $180 billion run rate last quarter and shows no signs of slowing anytime soon.īut Wall Street seems most concerned with the SaaS companies, the software firms built atop AWS and other public clouds. What you choose and how you choose to do it could depend on a lot of factors, but the trend is toward the cloud on all fronts.Īs Amazon-AWS boss Adam Selipsky pointed out during his keynote last week at AWS re:Invent, there is still only somewhere between 5% and 15% of workloads in the cloud.

WHY IS ZOOM STOCK DOWN INSTALL

Just about all software is delivered as a service these days– unless there’s a technical reason that makes more sense to manage it yourself.įor those folks, there is also software you can install in your cloud of choice or software you can build using one of the platform services and then install using the infrastructure services. Most people buy their software from companies like Salesforce, Okta, Box, Dropbox, DocuSign, Workday, ServiceNow and so many more, which manage it for them and provide updates on a regular basis automatically. According to data from Synergy Research, the entire cloud ecosystem grew 25% in the first half this year to $235 billion. The cloud ecosystem consists of three main elements - infrastructure, platform and software - all delivered as a service, as they say. The question is why investors can’t understand this and connect it to the short- and long-term performance of a given SaaS stock. It is in fact, the future of work, the future of computing, and anything that’s not digitized now will be sooner than later. It is not some pandemic-driven flash in the pan.

I’m not here to give financial advice, but I can tell you that digital tooling is not going away.

WHY IS ZOOM STOCK DOWN FULL

The same analysts who fawn over a stock one month dump it the next when the growth projection is suddenly smaller (and much more realistic), knowing full well no company can maintain the pandemic numbers we were seeing.

There is this persistent notion among investors that stocks that did well during the pandemic like Zoom, DocuSign and Okta will suddenly fade from our minds as soon as the pandemic subsides (if that ever happens). Sometimes I wonder if the analysts on Wall Street, who I’m sure are smart people, understand how the technology industry works.

0 kommentar(er)

0 kommentar(er)